10 Feb / Author: SK Tirumala

Impact of Mobile Telematics in Personal Auto Value Chain

Usage Based Insurance (UBI) continues to gain momentum in Personal Auto, with many leading insurers offering straightforward safe driving discounts, to more sophisticated pay-per-mile (PPM), pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD) products. Good drivers with clean driving history are shifting to these lower premium policies, in exchange for providing data on their driving routines and habits. While many consumers continue to be against sharing their driving data for privacy reasons, the tipping point is not far for a massive shift from buying standard policies to trying UBI policies. One of the biggest enablers this conversion is availability of smartphone-based telematics solutions, which are cheaper and easier to deploy than traditional hardware devices. This article however is about helping understand the big-picture impact a mobile telematics solution can have when bundled with digital policyholder services.

Many insurers are still in pilot mode and tip-toeing their way in, due to a variety of reasons ranging from concerns on meaningful adoption, to lack of conclusive proof that loss ratios would improve, to complexity of developing discount models that convince regulators, or to lack of trust on the technology itself and accuracy of data delivered by it. If the concern was just around technology and data, then we can weaken that argument with proof that well over 36% of the top personal auto insurers that cover over 50% of the personal auto market in the US are already using smartphone telematics to offer 15%-30% discount on premium in exchange for access to driving data. That would not have happened if the smartphone approach was still experimental, and had not proven to be working.

As it would be expected of any strategic initiative, launching UBI products and/or offering safe driver incentives, would also demand a solid business case and supporting ROI analysis, for approvals and organizational prioritization. Unlike typical technology projects that can be expensive, time-consuming and resource intensive, smartphone telematics solutions are simple to plan, quick to implement, and can deliver significant ROI. The reason is that a bundled smartphone solution can simultaneously advance many strategies, and deliver tangible benefits to multiple departments across the insurance value chain.

Even if a standalone mobile telematics solution (i.e. without other policyholder services) is pursued, the ROI is proven to be quite significant; with risk appropriate pricing driving the topline growth, and conscious driving the driving improvement to the bottom line. However, if the solution was bundled with digital policy and claim services, then benefits and the ROI are compounded further, to increased awareness and adoption.

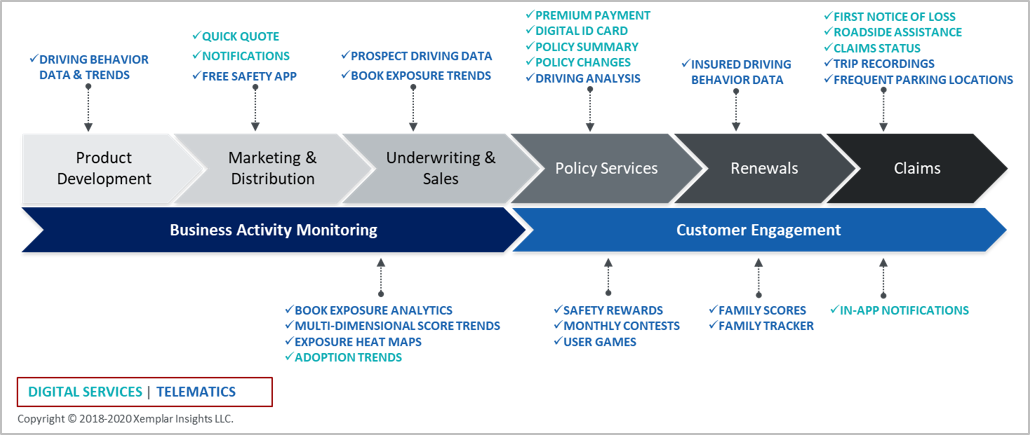

The picture below maps the features of a bundled mobile app across various links of the insurance value chain that can empower associated strategic objectives to improve risk selection, sales, and service.

No alt text provided for this image

The diagram also conveys that the key to maximizing benefits from smartphone-based telematics is to think beyond just reducing claim costs. Instead insurers should look at the opportunities that a well-scoped solution could create to sell, interact, and service better using mobile digital services, and simultaneously reducing the exposures with driving data analytics. The trick to achieving this high IRR is to develop an app that appeals to the policyholder as extremely useful tool to possess. Aggressive marketing across agency, social and digital channels is needed to generate awareness of the rich features offered in the app, with a clear articulation of “what’s in it for them”. If mobile app features are engaging, valuable and easy to use, consumers will be drawn to downloading and using the solution.

The estimated internal rates of return (IRR) for some initiatives have been well over 100% (15% IRR being a typical threshold to approve projects). It may appear too good to be true, but it is not far-fetched at all, especially when all of the possible benefits are captured by the solution.

For those who wish to start this journey cautiously, a well-planned crawl-walk-run strategy is a sound approach. It means begin with a digital policy services mobile solution, but with an embedded telematics engine that can be selectively turned on to test and refine the strategy of using driving behavior data for reducing exposures.

Many small to mid-sized insurers that have not initiated their mobile strategy have not yet realized the opportunities being missed by not having a mobile app for their customers. Mobile-responsive web portals cannot simply provide the experience customers are looking for. Moreover, with UBI products gaining momentum, it is time for these auto insurers to plan and prepare for what seems like an imminent transformation of auto insurance market. With modest investments, significant monetary benefits could be realized across the value chain, not to mention, the priceless value of saving lives by reducing accidents and making the roads safer.